Leadership Insights

Unveiling the Secrets: The Dynamics Driving Succesful Family Business Success

In the spectrum of perceptions, family businesses often occupy extremes: either envisioned as modest, local ventures or assumed to hail from powerhouse nations.

However, it's intriguing to note that some of the globe's wealthiest family enterprises not only challenge these stereotypes but also originate from seemingly modest nations.

Around 90% of global businesses are family owned. Comprising over 70% of the world's economic output, family businesses wield staggering influence, with an annual turnover ranging between $60 trillion and $70 trillion. Moreover, these enterprises serve as the backbone of global employment, responsible for approximately 60% of jobs worldwide.

Family businesses are not confined by borders; rather, they are dispersed across the globe, each uniquely attuned to meet specific needs within the economy.

While Walmart, headquartered in the USA, stands as the largest family-owned business globally, it's noteworthy that developing nations like India boast some of the world's largest family-owned enterprises. Among these are Reliance Industries, Mistry, Aditya Birla, Tata Group, and others, collectively contributing to 79% of the country's GDP.

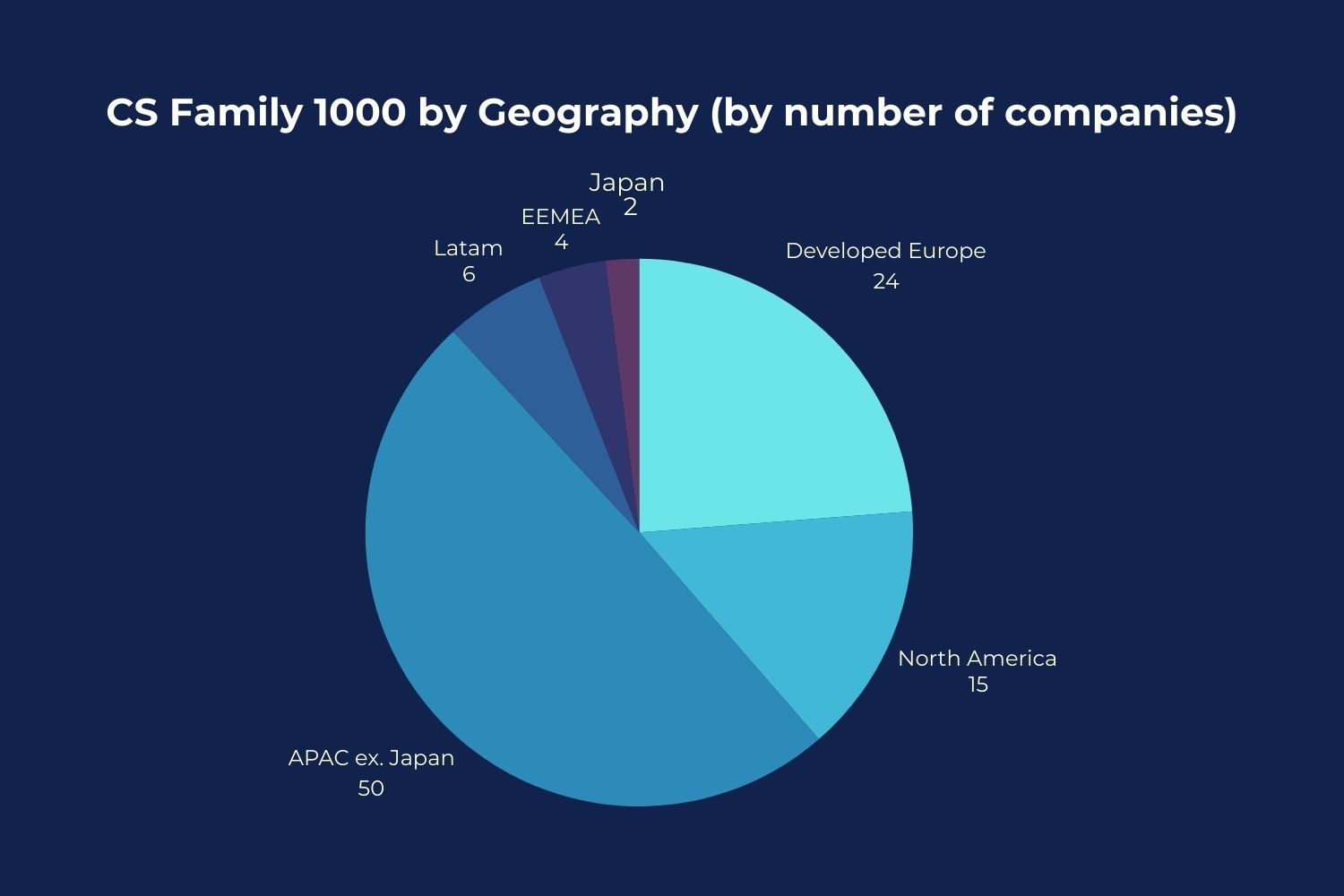

Global Distribution of Family Enterprises

According to Credit Suisse, the CS Family 1000 database encompasses family businesses meeting specific criteria:

either the founder or their family holds a minimum of 20% of the company's share capital,

or they control at least 20% of its voting rights.

As the younger generation boldly adopts new technologies and innovative strategies, they're not just creating wealth; they're accumulating it at an astonishing rate. Concurrently, according to FT, wealth, especially among Asian families, predominantly remains within their lineage, marking an unprecedented generational wealth transition. Notably, Japan alone contributes 2% to this wealth landscape through family businesses, distinct from the 50% attributed to the broader Asia-Pacific region. This momentous shift underscores a pivotal trend: wealth is in motion. From entrenched strongholds in developed nations and continents, it is steadily gravitating toward Asia, signalling a transformative epoch in global economics.

What makes Family Owned Businesses Successful?

Family businesses wield a distinct advantage over their non-family counterparts, carving a path defined by their individualistic ethos and resilience. Their success stems from a strategic embrace of enduring values, characterised by a steadfast commitment to long-term investments and relationships.

Operating with a Long-term Focus

Family businesses exhibit a remarkable capacity for prioritising long-term sustainability over immediate profitability. Unlike publicly traded companies beholden to shareholders' quarterly expectations, family-owned enterprises have the freedom to make decisions with a horizon extending far beyond financial reporting periods. This also affords them the luxury of investing in initiatives that may not yield immediate returns but contribute significantly to the company's enduring success. By nurturing a culture that values longevity and resilience, family businesses create a sturdy foundation upon which they can weather economic downturns and industry disruptions. Enterprises fixated on short-lived gains hastily latch onto emerging trends to gain rapid returns, often forsaking sustained prosperity. In stark contrast, research illuminates that family-run ventures entrenched in long-range visions and strategies meticulously survey their surroundings to anticipate distant shifts, priming themselves to capitalise on unfolding opportunities promptly.

Burman, an Indian company that has been successful for five generations or more, can be attributed to its steadfast commitment to long-term strategic planning.

Guarded Innovation Initiatives

Family businesses exhibit a distinctive approach to innovation, characterised by efficient resource utilisation, abundant social capital, and resilience in navigating dynamic market landscapes. Despite allocating fewer funds to research and development (R&D) compared to non-family enterprises, family businesses demonstrate a remarkable ability to maximise the impact of their investments in innovation through astute decision-making by deeply committed family members. Additionally, their rich reservoir of social capital fosters an environment conducive to creativity and idea generation, while strong industry relationships facilitate collaboration and knowledge exchange essential for driving innovation. Leveraging these inherent strengths, family businesses showcase resilience and adaptability, positioning themselves as agile players capable of thriving amidst evolving industry trends and economic uncertainties.

However, family businesses are breaking barriers and embracing innovation, particularly in the wake of the recent surge in AI technologies.

Strong Values and Culture

Central to the essence of family businesses are their unique values and cultural identity, cultivated over years of heritage and tradition. These values, instilled by founders and carried forward by successive generations, form the bedrock of the company's ethos. Ranging from a steadfast commitment to integrity and accountability to a strong sense of community and social responsibility, family firms prioritise principles that extend beyond profit margins. This shared cultural heritage fosters a cohesive organisational identity, fostering employee engagement and loyalty. Amidst an increasingly homogenised business landscape, these deeply ingrained values serve as a defining feature of family businesses, distinguishing them through their authenticity and principled approach to business.

A study by CultureIQ found that companies with a strong culture outperform their competitors by 4x in terms of revenue growth.

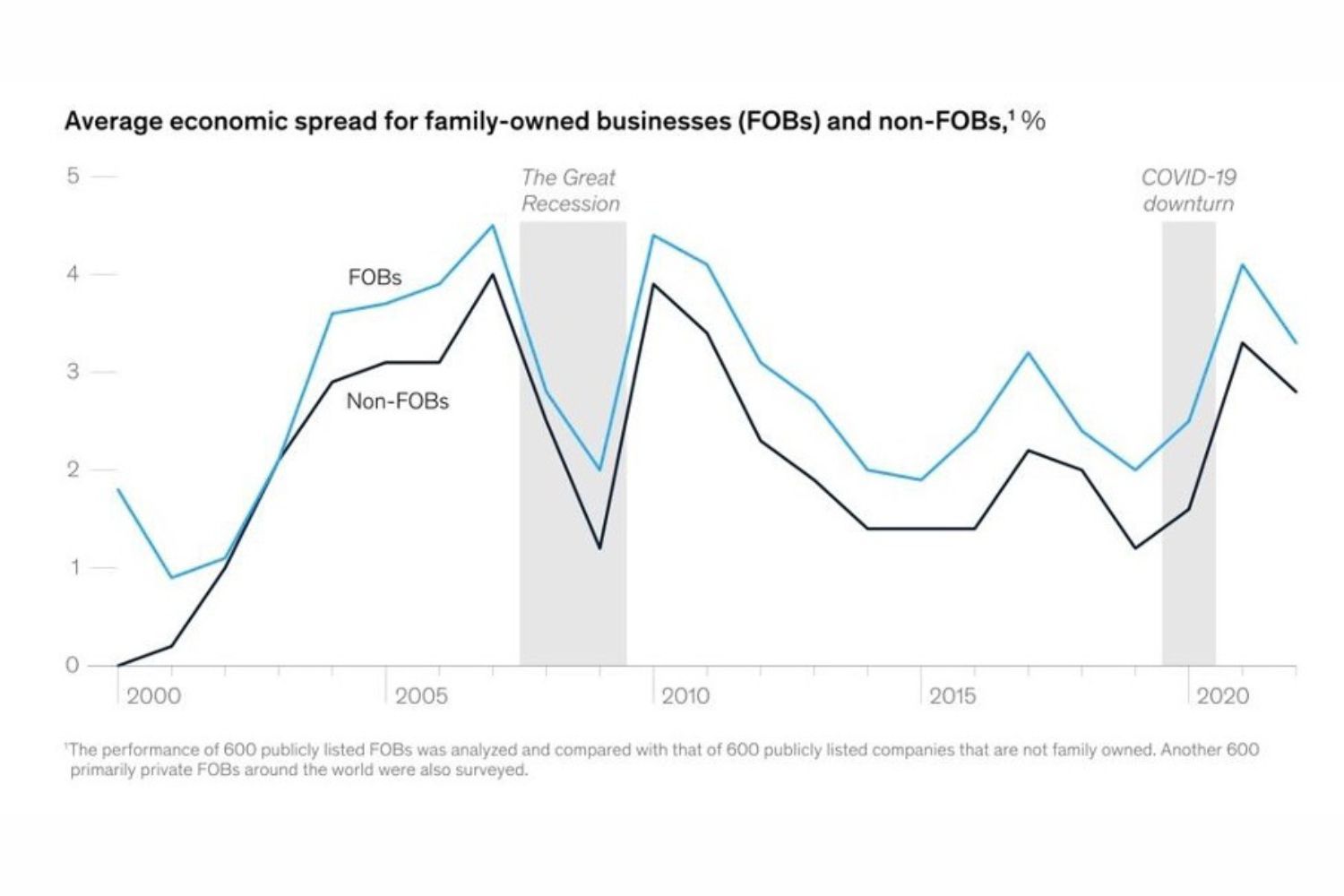

Blue – Family Owned Businesses Black – Non Family Owned Businesses

Shrewd Financial Planning

Family-owned enterprises demonstrate a steadfast commitment to the prudent management of their financial assets, recognising their pivotal role in preserving the family's heritage and ensuring long-term prosperity. In contrast to their non-family counterparts, family businesses adopt a cautious financial strategy, opting for conservative levels of leverage. Research also suggests that family firms prioritise building reserves during profitable periods rather than relying on debt financing, allowing them to weather economic downturns more effectively.

Additionally, their preference for equity financing over debt financing enables family-owned enterprises to maintain greater control over their financial structure and mitigate risks associated with excessive indebtedness. A key characteristic of family businesses lies in their adept business operations management, marked by a propensity for lower risk and the maintenance of robust financial profiles. This attribute proves invaluable in times of economic adversity, showcasing their resilience and enduring sustainability.

Distinguished by their unique capital structure, family enterprises stand apart from non-family businesses. They rely on conservative financial practices to navigate uncertainties with confidence and foresight.

Sustaining Talent Retention

Family businesses place significant emphasis on human capital, recognising the critical role of talented executives in driving long-term success. This is evident in the importance they attribute to their employees, with a particular emphasis on C-suite executives, who often possess extensive experience and deep-rooted commitment to the company's values. Unlike non-family enterprises, where leadership turnover may be more frequent, family firms prioritise continuity in their top management, with CEOs often serving lengthy tenures. This stability not only fosters trust and confidence among stakeholders but also enables the C-suite to develop and execute strategic initiatives with a deep understanding of the company's history, culture, and long-term objectives.

CEOs of family-owned businesses are over twice as likely to have served in their positions for more than a decade.

As businesses continually evolve, the significance of an adept and cohesive C-suite cannot be overstated. While continuity and stability are crucial, it is equally vital to have individuals equipped with the requisite skills and vision to navigate the complexities of the modern business landscape.

Consult with our experts to fortify your leadership team for the challenges of tomorrow.