Leadership Insights

Asia's Commercial Real Estate Revival and Leadership Imperatives

In the wake of unprecedented global events, the real estate landscape has undergone profound shifts, marked by uncertainty and resilience in equal measure. The onset of the COVID-19 pandemic further amplified the shift, reshaping industry dynamics and challenging conventional notions of stability.

However, amidst this turbulence, one region has been standing out from the rest: Asia Pacific.

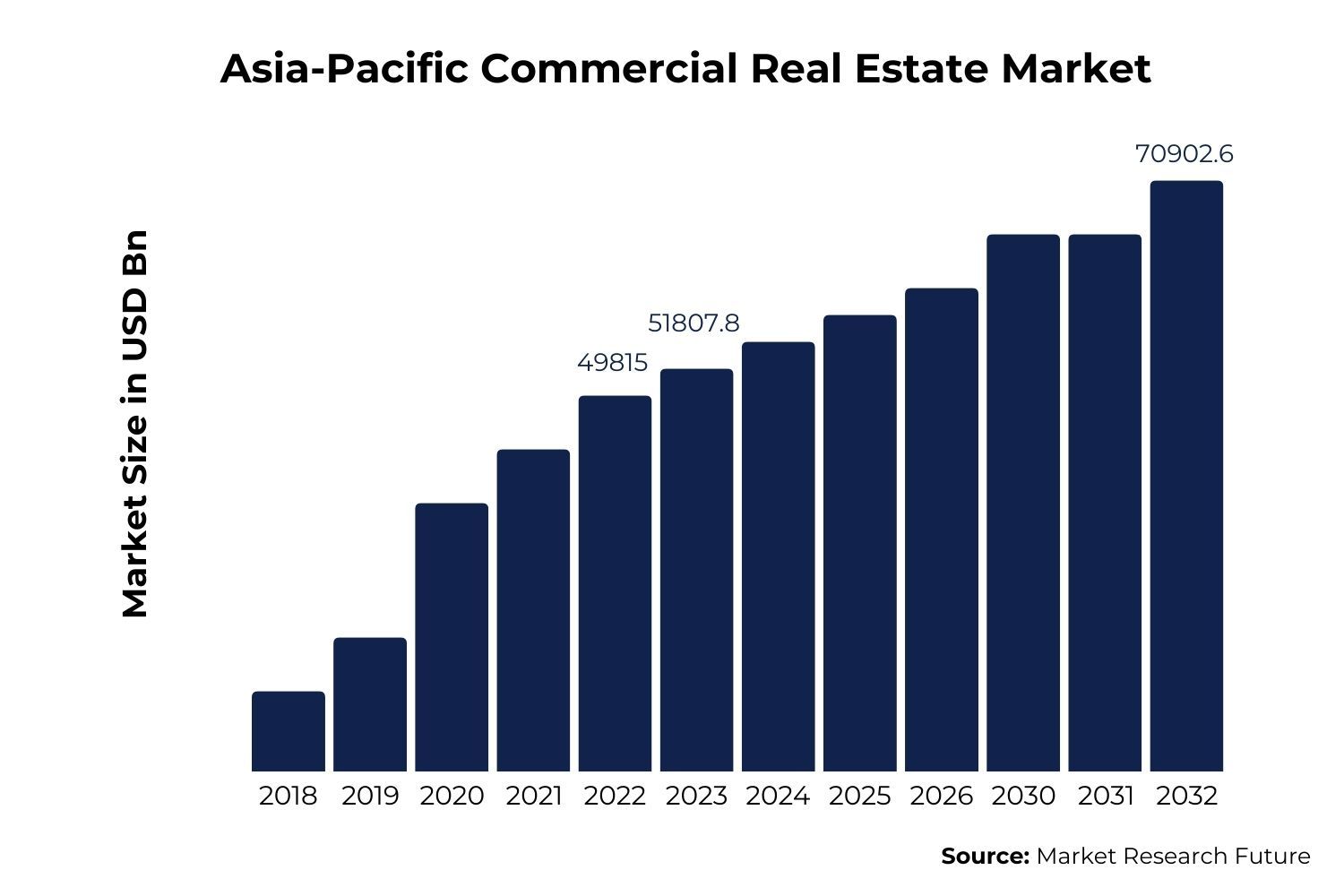

Recent data from JLL, as reported by The World Property Journal, sheds light on this remarkable trend: amidst global uncertainties, the Asia Pacific real estate industry has not just weathered the storm but is forging ahead with vigour and vitality. In the first quarter of 2024, commercial real estate investments in the Asia Pacific surged to an impressive USD 30.5 billion, marking a substantial 13 percent year-over-year increase and signalling the region's resilience and potential.

Commercial real estate investments in the Asia Pacific surged to an impressive USD 30.5 billion.

Key Players in Asia Pacific’s Real Estate Resurgence

In the evolving landscape of Asia Pacific's real estate resurgence, North Asia stands out with a performance that has captivated investors worldwide. Japan, at the forefront, has attracted a remarkable $11.5 billion in real estate investments. This significant capital influx underscores Japan's blend of tradition and innovation, positioning it as a beacon of resilience and opportunity. The report says that domestic investors are focusing on core assets, driven by a deep understanding of market fundamentals and a commitment to stability and long-term growth. Concurrently, international investors are drawn to Japan's advanced technology and progressive policies, targeting ventures that span from cutting-edge office complexes to state-of-the-art logistics centres.

Singapore, with $2.2 billion in real estate investments, emerges as a focal point of reinvention and strategic opportunity. The city-state's real estate sector is undergoing a significant transformation, moving towards traditional retail paradigms. The country’s real estate industry is integrating digital technologies to enhance customer experiences and drive business innovation. From seamless online-to-offline retail experiences to personalised marketing strategies powered by data analytics, the city- state is at the forefront of leveraging technology to create value for both consumers and businesses.

South Korea, strategically located in the southeast, has also made substantial strides, attracting $4.3 billion in real estate investments. This reflects a 73% year-over-year increase, highlighting the country's resilience and adaptability. South Korea’s real estate narrative is one of transformation, particularly within the office sector, which is evolving towards modernity. This commitment to progressive development is reshaping South Korea's urban landscapes and reinforcing its position as a prime investment destination in the Asia Pacific region.

The Road Ahead: Predictions for the Future

The Asia Pacific real estate market is poised for a significant resurgence in the latter half of 2024, according to a report by CBRE. This anticipated upturn is set to be driven predominantly by private investors and corporate entities with a keen eye for high- quality assets. The report says that as economic conditions stabilise and growth prospects brighten, these investors are increasingly drawn to the region’s diverse opportunities, seeking to capitalise on both stability and potential for high returns.

Private investors are expected to play a pivotal role, leveraging their flexibility and swift decision-making capabilities to snap up premium properties. These investors are particularly interested in prime office spaces, luxury residential units, and cutting-edge logistics centres, which promise not only immediate value but also long-term appreciation. Their focus is not merely on acquiring assets but also on enhancing them through strategic upgrades and sustainable practices, aligning with global trends towards environmental responsibility and efficiency.

Corporate investors, on the other hand, are looking to expand their real estate portfolios by targeting assets that support their operational needs and growth strategies. With many companies seeking to establish or expand their presence in key Asia Pacific markets, there is a strong demand for modern office spaces equipped with advanced technological infrastructure. Additionally, the rise of e-commerce and the need for sophisticated supply chain solutions are driving corporate interest in high- quality logistics and industrial properties.

Additionally, CBRE's projections indicate a prospective 5% to 10% rebound in the overall investment volume across the Asia Pacific region for the year 2024, as compared to the levels observed in 2023.

Shifting Demands for Leaders in the New Age of Real Estate

As the real estate market transforms, leaders must adapt and evolve to effectively navigate these changes. The traditional paradigms of real estate leadership, centred around stability and conventional investment strategies, are being challenged by investors' evolving needs, shifting market dynamics, and technological advancements reshaping the industry. Hence, it becomes imperative for real estate leadership to undergo a corresponding evolution.

Agility in Investment Strategies: In this speed-changing market environment, C-suite leaders have no choice but to demonstrate agility in their investment strategies to capitalise on emerging opportunities and mitigate risks. This may involve diversifying investment portfolios across asset classes, geographic regions, and risk profiles. By maintaining a balanced approach and staying attuned to market trends, leaders can optimise returns, navigate market uncertainties, and sustain long-term growth in the real estate industry.

Embracing Proptech Integration: The real estate industry is witnessing a rapid influx of technology-driven innovations, collectively termed Proptech. C-suite leaders must actively embrace technologies such as AI-driven property management platforms, virtual reality (VR) for immersive property tours, and blockchain for secure transactions. With the opportunity to integrate Proptech into their operations, leaders can effectively streamline processes, enhance customer experiences, and stay competitive in an increasingly digital marketplace.

Sustainability as a Priority: With increasing awareness of environmental issues and regulatory pressures, sustainability has become a critical consideration in the real estate industry. C-suite leaders must embrace and prioritise sustainability initiatives such as green building certifications, energy-efficient designs, and renewable energy integration. This is an opportunity for leaders to mitigate environmental risks, enhance property value, attract eco-conscious tenants, and future-proof their investments against regulatory changes.

Data-Driven Decision-Making: In an era of big data and analytics, C-suite leaders must leverage data-driven insights to inform their decision-making processes. By harnessing data analytics, leaders can gain deeper insights into market trends, customer preferences, and investment opportunities. This enables them to make informed decisions, optimise asset performance, and drive strategic growth initiatives with greater precision and confidence.

In a nutshell, these are just the visible portion of the iceberg in the realm of real estate leadership. Authentic leadership in the real estate market demands a multifaceted approach that encompasses strategic vision, adaptability, innovation, and a deep understanding of market intricacies. The road ahead? C-suite leaders who aspire to steer their organisations towards sustained success must continually evolve, embracing new challenges and opportunities with resilience and foresight.

Ready to elevate your real estate leadership game? Contact one of our Consultants or email contact@selionglobal.com for a confidential discussion about how we can help with leadership development and talent acquisition.