Leadership Insights

A Juggling Act - India's Quest for a Balanced Energy Future

India stands at a critical juncture. As an emerging economic powerhouse, India faces the challenge of fueling its ambitions while ensuring energy security, affordability, and environmental sustainability. Home to nearly a sixth of the world’s population, India’s energy demand is set to double by 2050, reaching 80 exajoules (EJ) annually[i] from about 42 EJ in 2022. This presents a critical juncture – a “juggling act”- where India must balance the imperative of affordable energy to support its economic growth with the urgent need for energy security and environmental sustainability. Unlike the conventional fuels-led growth trajectory followed by developed nations, India has a unique opportunity to leapfrog to a cleaner energy future and set an example for the rest of the developing world.

Mansi Madan Tripathy, Chairperson of the Shell Group of Companies India & VP of Shell Lubricants APAC, shares insights into the country’s innovative approaches to tackling energy challenges.

[i] Shell International, The Energy Security Scenarios, 2023.

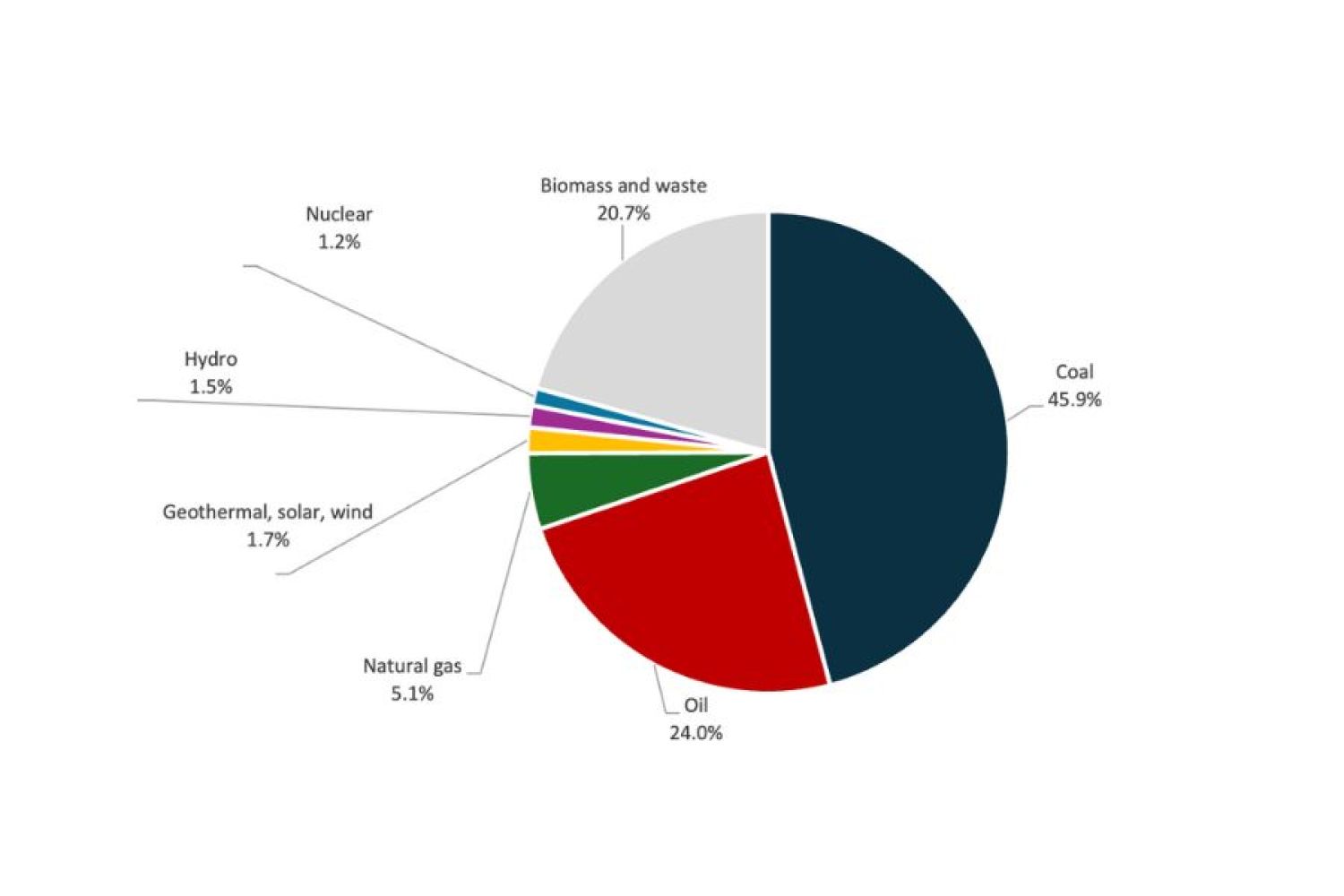

India's Total Energy Supply (2022): ~42EJ. Source: International Energy Agency (IEA), Energy System of India

Today, India’s energy landscape is dominated by conventional fuels, primarily coal which formed about 46% of India’s total energy supply[i]. In terms of energy consumption, power, industrial and transport sectors are some of the largest energy consumers accounting for roughly 34%, 22% and 10% respectively of India’s primary energy demand[ii]. Together, they also account for about 70% of India’s emissions[iii]. Each of them will need a set of technological and regulatory interventions to transition to a net zero emissions future.

[i] IEA, Energy System of India, 2022. [ii] Mckinsey, India Decarbonization, October 2022. [iii] Mckinsey, India Decarbonization, October 2022.

The Power sector is the single largest source of India’s greenhouse gas emissions[i]. Coal-fired generation accounts for about 70% of gross generation mix[ii] and a large share of emissions for the sector. However, with abundant solar and wind resources and declining costs, renewable energy is becoming increasingly competitive. We can see this already playing out as India has made significant strides in renewable energy adoption, with the country already achieving its target of 40% of installed electricity capacity from non-fossil energy sources in 2021[iii]. The path forward for India will be to decouple the demand for coal from the overall demand for power by accelerating the deployment of solar and wind generation and investing in transmission and distribution networks. However, as renewable energy grows in India’s power generation mix with the country aiming to achieve 500GW installed capacity from renewable sources by 2030[iv], the challenge will be to maintain grid reliability due to inherent intermittency of renewable energy. Therefore, thermal power generation will continue to play a key role. Here, natural gas can play a crucial role as a transition fuel, providing flexibility and reliability to the energy system. Gas-based power offers a lower-carbon alternative to coal and helps address the intermittency of renewables[v].

[i] Shell Scenarios Sketch, India transforming to a net-zero emissions energy system.[ii] Central Electricity Agency, Report on Optimal Generation Capacity Mid for 2029-2030, 2023. [iii] Ministry of New and Renewable Energy, Press Release, December 2021. [iv] Ministry of New and Renewable Energy, Press Release, November 2024.[v] Liquefied natural gas (LNG) | Shell Global.

The Transport sector, a significant and growing contributor to emissions, shows promise with advancements in bioethanol blending in conventional fuel and electric mobility. As the world's third-largest producer and consumer of bioethanol[i], India has seen domestic production triple over the past five years[ii]. This growth, supported by abundant feedstocks and effective policy implementation, has resulted in an ethanol blending rate of around 14%[iii], one of the highest globally. This will play a crucial role in enhancing India's energy security, reducing import bills, managing air pollution, and creating rural employment.

Electrification is an important lever for decarbonisation of the transport sector, yet, only some segments such as passenger, last-mile and light-duty transport are suitable for electrification in the medium term. The surge in electric two- and three-wheeler adoption signals a promising future of electric mobility in India. For other segments, such as long-distance road freight and aviation, the decarbonisation pathway will require a variety of solutions and policy support. For instance, in heavy-duty transportation, liquefied natural gas (LNG) offers significant advantages over diesel in terms of economic viability, air pollution control, and lowering carbon emissions.

[i] Ministry of Consumer Affairs, Food and Public Distribution, Press Release, September 2024. [ii] Ministry of Petroleum and Natural Gas, Government of India, Report on Ethanol Growth Story. [iii] Based on Petroleum Planning & Analysis Cell, Snapshot of India's Oil and Gas Data, November 2024.

Similar to the transport sector, the industrial sector accounts for a significant share of India’s emissions. The sector, consisting of both heavy and light industries, will drive rapid growth in energy demand over the next few decades as India industrialises. The immediate levers for decarbonisation include improving energy and resource efficiency, and electrification of processes. For processes that need high-temperature heat or cannot readily be electrified, switching to alternatives such as green hydrogen could be a feasible solution. The government’s focus on promoting green hydrogen, driven by the launch of the National Green Hydrogen Mission and Production-Linked Incentives (PLI) scheme for the value chain, presents a significant opportunity to decarbonise various hard-to-abate sectors, such as the steel industry. India is well-positioned to become a leader in green hydrogen production and utilisation due to its renewable energy potential.

The stakes are high. There needs to be a balanced and orderly transition, one that maintains secure energy supplies while accelerating the transition to affordable low-carbon solutions. We must tread carefully to avoid dismantling the current energy infrastructure faster than we construct the lower-carbon energy system of tomorrow. In India’s context, a judicious mix of conventional and lower-carbon sources of energy is necessary to ensure a secure supply of affordable energy during the transition.

The pace of the transition hinges strongly on factors like affordability, technological advancements, and evolving consumer preferences shaped by government policies. Collaboration between the government and industry is paramount to catalyse demand, establish supply chain infrastructure, and ensure favourable economic outcomes across the value chain. Simultaneously, energy suppliers must work together with energy users to progressively decarbonise their energy use. Industry partnerships are vital for demand aggregation, generating supplies, derisking the supply value chain, and balancing the immediate economic costs with the long-term benefits. With the right policies and stakeholder collaboration, the energy transition can provide opportunities for balanced and sustainable economic development that improves the lives of all citizens.

The views expressed in this article are those of the author and do not necessarily reflect the position or policy of Selion Global.